Gov. Abbott to authorize SB 4, SB 23, HB 9 right into law

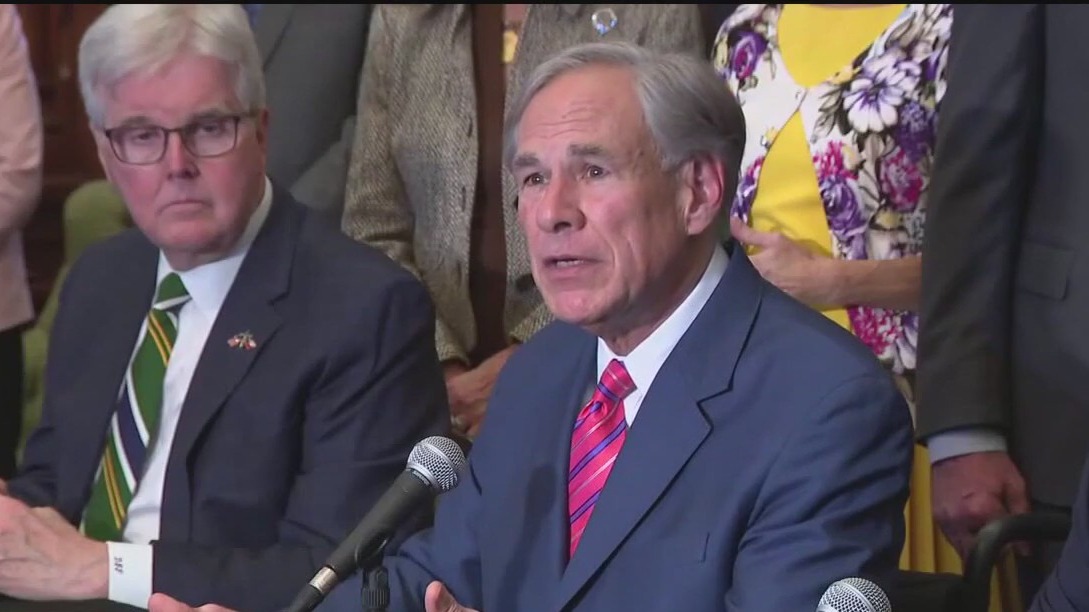

Governor Greg Abbott is set up to authorize Us senate Expense 4 (SB 4), Us Senate Expense 23 (SB 23), and Residence Expense 9 (HB 9), a crucial component of the 89th Legislature’s $10 billion real estate tax alleviation plan, right into regulation on Monday, June 16, 2025, at 3:00 PM at the Robson Cattle Ranch Club Heritage Space in Denton, Texas.

DENTON, Texas – Gov. Greg Abbott is readied to authorize a $10 billion real estate tax alleviation plan right into regulation on Monday, a step supporters claim will certainly offer considerable cost savings for home owners, senior citizens, and local business proprietors throughout Texas.

The finalizing event for 3 vital costs is set up for 3 p.m. at the Robson Cattle Ranch Club in Denton. The regulations, an item of the 89th Legislature, will certainly precede citizens for last authorization in the November 2025 constitutional change political election.

Information of the Tax obligation Alleviation Bills

Big image sight:

The plan consists of Us senate Expense 4, Us senate Expense 23, and Residence Expense 9. Authored by state Sen. Paul Bettencourt, R-Houston, and state Rep. Morgan Meyer, R-Dallas, the costs intend to improve previous tax-cutting initiatives.

” SB 4 and SB 23 improves the 2023 energy of the biggest real estate tax cut in united state background, a record-breaking $22.7 billion, with targeted exceptions to assist countless Texans,” Bettencourt claimed.

The certain steps consist of:

- Us senate Expense 4: This expense would certainly boost the homestead exception for college area tax obligations from $100,000 to $140,000. This is predicted to conserve the typical property owner $484 every year.

- Us senate Expense 23: This regulations increases the real estate tax exception for Texans over 65 and those with handicaps from $10,000 to $60,000. When incorporated with the suggested homestead exception, their complete exception would certainly get to $200,000, leading to a typical yearly cost savings of over $950 for greater than 2 million home owners.

- Residence Expense 9: This expense targets local business by increasing the exception for organization personal effects to $125,000. The predicted typical yearly cost savings for entrepreneur is $2,500.

Assistance from State Leadership

What they’re claiming:

Lt. Gov. Dan Patrick commended the collective initiative behind the regulations.

” The Senators and our Residence coworkers from both sides comprehend when boosted homestead exception and even more compression are incorporated, Texans get optimal tax obligation alleviation advantage,” Patrick claimed in an interview. He specified that when incorporated with a $22.7 billion tax obligation cut from the previous session, Texas home owners will certainly see an overall typical decrease of $1,762.87.

The flow of these costs right into regulation is contingent on citizen authorization in November. Bettencourt revealed self-confidence that Texans will certainly sustain the steps, mentioning comparable authorizations in 2015, 2022, and 2023.

” This will certainly assist countless Texans remain in their homes, allow senior citizens age in position, and permit others to expand their services for generations ahead,” Bettencourt claimed.

The Resource: Info in this write-up originates from a press release provided by Legislator Paul Bettencourt’s workplace at the State Funding.