Buying back-to-school products? Texas’ yearly sales tax obligation vacation will certainly allow individuals acquire back-to-school clothing, shoes and products without paying sales tax obligation beginning on Friday and finishing Sunday evening.

” Qualifying things can be acquired free of tax from a Texas shop or from an online or brochure vendor doing service in Texas,” reviewed a summary from the state administrator’s web site. “Most of the times, you do not require to offer the vendor an exception certification to acquire certifying things free of tax.”

The state initially began supplying its tax-free weekend break to customers in 1999, and has actually ever since conserved customers an approximated $1.8 billion.

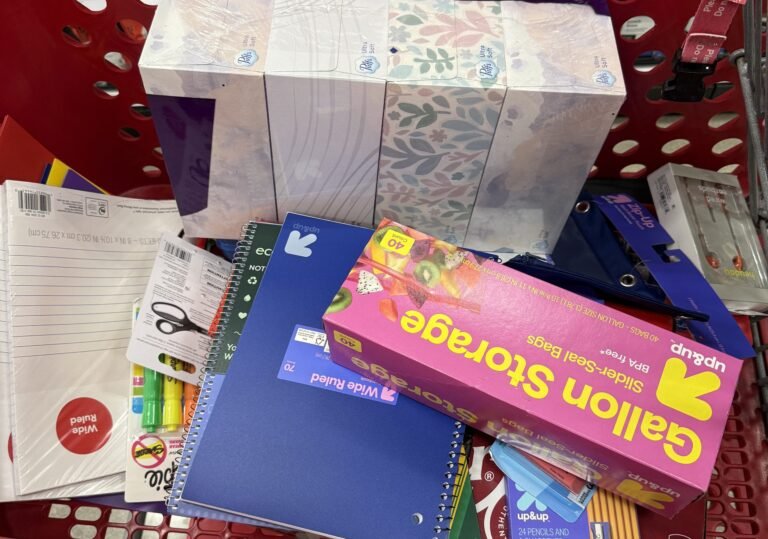

Clothes that you can obtain free of tax this weekend break consist of infant diapers, baseball caps, sporting activities jackets, searching clothing, precursor attires, a lot of tennis shoes and swimwears.

Materials consist of every little thing from knapsacks and pastels to folders and lunch boxes.

School products or clothing acquired need to be under $100 and not all things certify. A complete checklist of college products and apparel things that are free of tax over the weekend break can be located on the state administrator’s web site.

Nearly a lots back-to-school occasions with cost-free products will certainly be held throughout the weekend break, too. San Antonio family members can go to numerous occasions to obtain knapsacks, hairstyles, inoculations and even more.

The tax obligation vacation does not put on delivery and managing prices.

If customers are billed a sales tax obligation on a certifying acquisition, they can request a reimbursement or can apply for a reimbursement straight with the state by filling in Type 00-985 and sending it to the state administrator.

The mailing address for the state administrator is P.O. Box 13528, Capitol Terminal, Austin, Texas 78711-3528.