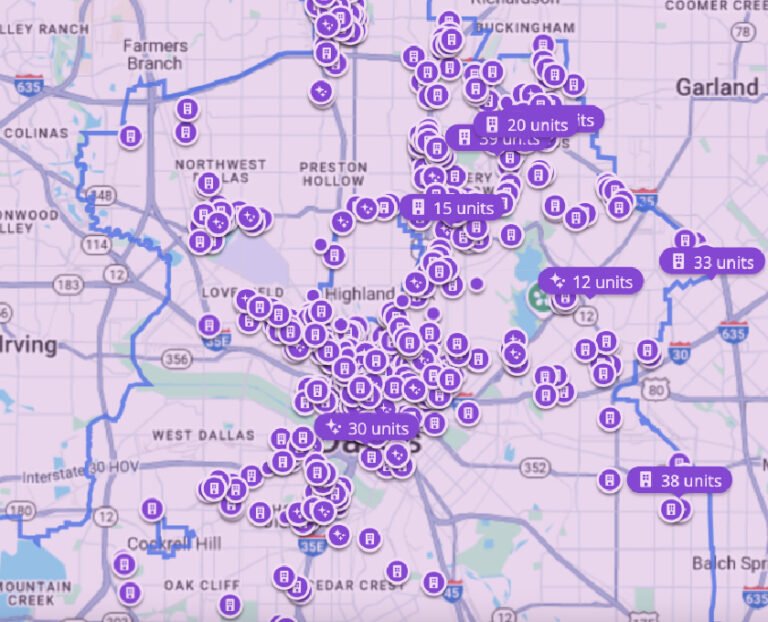

While some records have actually recommended the shipment of even more real estate supply to D-FW over the in 2015 has actually equipped customers by providing extra alternatives and bargaining take advantage of, a current research study by RentCafe reveals there are still a lot of headwinds in the area’s rental market.

D-FW tenants are really taking care of among the tightest real estate markets in the Lone Celebrity State. With need climbing, lease revivals up, and brand-new apartment or condo supply falling back, Dallas and Ft Well worth ranking 2nd and 3rd, specifically, for the most affordable rental market amongst the 5 largest city locations in Texas, behind only Houston.

” Both Dallas and Ft Well worth saw a rise in lease revivals, recommending that tenants in these locations are significantly completely satisfied with their existing houses and aspire to secure existing prices for longer,” claimed RentCafe author and research study expert Veronica Grecu in a declaration to CandysDirt.com.

The revival price in Dallas raised from 56.8% to 61.2% year over year. Ft Well worth’s revival price ticked up, albeit not as much, from 61.4% to 63%. Grecu took place to keep in mind that the typical size of remain in a Dallas apartment or condo is quite high at 23 months.

” With several tenants having actually relocated right into freshly constructed houses in the previous 2 years, less are seeking to move currently,” she claimed.

In spite of all the multifamily building and construction taking place, the share of brand-new devices in Dallas heading right into the rental period saw a year-over-year dip, with the city clocking a price of 0.61% in 2025, below 1%.

Grecu called the reduction a “noteworthy downturn.”

” When you incorporate that with a climbing lease revival price and secure need metrics throughout the board (like variety of potential tenants per houses), it signifies an extra open market in advance,” she claimed.

Checking out Ft Well Worth, some 0.81% of its apartment or condo devices were brand-new heading right into the 2025 rental period.

Still, while the D-FW’s 2 front runner cities rated high for rental market competition amongst Texas’ largest cities, they really rated less than smaller sized cities in the state. Dallas and Ft Well worth were granted affordable ratings of 73.1 and 71.1, specifically. At the same time, Lubbock, Amarillo, Central Texas, Midland-Odessa, El Paso, and Corpus Christi gained greater ratings.

Zooming out also better, however, multifamily real estate competitors in Texas was less than in various other components of the nation.

” Many thanks to the apartment or condo supply included current years, rental markets in Texas stay even more easily accessible contrasted to locations like Miami or country Chicago,” Grecu claimed. “Therefore, despite having boosting need, no Texas city locations rated amongst the leading 20 most affordable rental markets nationwide this period.”

You can see just how the remainder of the nation, damaged down by areas and markets, compares to D-FW by checking out the complete research study right here.

RentCafe’s information was sourced from the residential or commercial property administration software program company Yardi Solution, which drew info from 139 rental markets throughout the USA. The research study group especially assessed rental market information from market-rate multifamily buildings without any less than 50 devices. “Completely cost effective multifamily buildings were left out,” according to the research study’s method.

To establish affordable ratings, RentCafe appointed heavy worths to 5 aspects throughout the initial quarter of this year: apartment or condo tenancy price, typical overall days uninhabited, potential tenants per uninhabited device, revival lease price, and “share of brand-new houses finished throughout the very same duration contrasted to the existing total supply at the beginning of Q1 2025.”