The Fed’s crucial temporary rates of interest, which affects various other loaning prices for points like home loans and vehicle financings, is presently 4.3%.

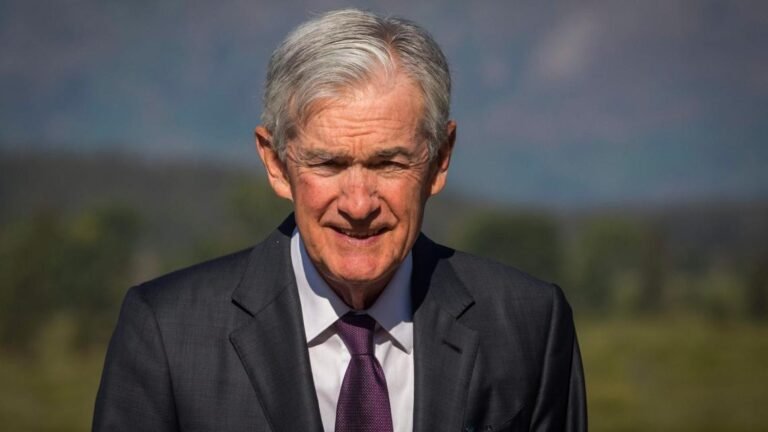

WASHINGTON– Since Federal Book Chair Jerome Powell has actually indicated that the reserve bank might quickly reduce its crucial rates of interest, he deals with a brand-new obstacle: just how to do it without appearing to cave to the White Residence’s needs.

For months, Powell has actually mostly disregarded Head of state Donald Trump’s continuous hectoring that he lower loaning prices. Yet on Friday, in a highly-anticipated speech, Powell recommended that the Fed might take such an action as quickly as its following conference in September.

It will certainly be a filled choice for the Fed, which need to evaluate it versus relentless rising cost of living and an economic climate that might additionally boost in the 2nd fifty percent of this year. Both patterns, if they happen, might make a cut appearance early.

Trump has actually prompted Powell to reduce prices, suggesting there is “no rising cost of living” and claiming that a cut would certainly reduce the federal government’s passion repayments on its $37 trillion in the red.

Powell, on the various other hand, has actually recommended that a price cut is most likely for factors fairly various than Trump’s: He is stressed that the economic climate is damaging. His comments on Friday at a financial seminar in Grand Teton National Forest in Wyoming additionally suggested that the Fed will certainly relocate very carefully and reduce prices at a much slower rate than Trump desires.

Powell indicated financial development that “has actually reduced significantly in the initial fifty percent of this year,” to a yearly price of 1.2%, below 2.5% in 2015. There has actually additionally been a “significant slowing down” in the need for employees, he included, which intimidates to increase joblessness.

Still, Powell claimed that tolls have actually begun to raise the rate of items and might remain to press rising cost of living greater, an opportunity Fed authorities will carefully keep track of which will certainly make them mindful regarding added price cuts.

The Fed’s crucial temporary rates of interest, which affects various other loaning prices for points like home loans and vehicle financings, is presently 4.3%. Trump has actually asked for it to be reduced as reduced as 1%– a degree no Fed authorities sustains.

Nonetheless the Fed moves on, it will likely do so while remaining to insist its historical self-reliance. A politically independent reserve bank is thought about by a lot of economic experts as essential to stop rising cost of living, due to the fact that it can take actions– such as increasing rate of interest to cool down the economic climate and battle rising cost of living– that are harder for chosen authorities to do.

There are 19 participants of the Fed’s interest-rate setup board, 12 of whom elect on price choices. Among them, Beth Hammack, head of state of the Federal Book’s Cleveland branch, claimed Friday in a meeting with The Associated Press that she is dedicated to the Fed’s self-reliance.

” I’m laser concentrated … on making sure that I can supply excellent end results for the for the general public, and I attempt to ignore all the various other sound,” she claimed.

She stays worried that the Fed still requires to combat persistent rising cost of living, a sight shared by a number of associates.

” Rising cost of living is too expensive and it’s been trending in the incorrect instructions,” Hammack claimed. “Now I see us relocating far from our objectives on the rising cost of living side.”

Powell himself did not go over the Fed’s self-reliance throughout his speech in Wyoming, where he obtained an applause by the set up academics, economic experts, and reserve bank authorities from around the globe. However Adam Posen, head of state of the Peterson Institute for International Business economics, claimed that was likely a calculated option and planned, actually, to show the Fed’s self-reliance.

” The not discussing self-reliance was a method of attempting as finest they might to signify we’re moving on with business,” Posen claimed. “We’re still having a civil interior conversation regarding the advantages of the concern. And also if it pleases the head of state, we’re mosting likely to make the appropriate telephone call.”

It protested that background that Trump escalated his very own stress war one more leading Fed authorities.

Trump claimed he would certainly terminate Fed Guv Lisa Chef if she did not tip down from her placement. Expense Pulte, a Trump appointee to head the company that manages home mortgage titans Fannie Mae and Freddie Mac, declared Wednesday that Chef dedicated home mortgage scams when she acquired 2 residential or commercial properties in 2021. She has actually not been billed.

Chef has actually claimed she would certainly not be “harassed” right into surrendering her placement. She decreased Friday to discuss Trump’s danger.

If Chef is in some way eliminated, that would certainly provide Trump a possibility to place a patriot on the Fed’s regulating board. Participants of the board ballot on all rates of interest choices. He has actually currently chosen a leading White Residence economic expert, Stephen Miran, to change previous guv Adriana Kugler, that tipped down Aug. 1.

Trump had actually formerly endangered to terminate Powell, yet hasn’t done so. Trump selected Powell in late 2017. His term as chair finishes in regarding 9 months.

Powell is familiar with Trump’s strikes. Michael Pressure, supervisor of financial plan researches at the American Venture Institute, kept in mind that the head of state additionally pursued him in 2018 for increasing rate of interest, yet that really did not quit Powell.

” The head of state has a lengthy background of using stress to Chairman Powell,” Pressure claimed. “And Chairman Powell has a lengthy background of standing up to that stress. So it would certainly be weird, I assume, if on his escape the door, he caved for the very first time.”

Still, Pressure believes that Powell is overstating the threat that the economic climate will certainly damage better and press joblessness greater. If rising cost of living worsens while employing proceeds, that might require the Fed to possibly turn around program and rise prices once more following year.

” That would certainly do more damages to the Fed’s reputation around preserving reduced and steady rate rising cost of living,” he claimed.

Copyright 2025 Associated Press. All civil liberties booked. This product might not be released, program, reworded, or rearranged.