Consumer assumption of increasing inflation has actually been expanding considering that the start of the year. The toll outbursts are causing even more damages to the United States economic situation than any kind of various other nation, and the complete influence has yet to be really felt by United States customers.

The brand-new tax obligation expense that simply passed your home will certainly increase the government shortage by 4.5 trillion bucks, and Moody’s simply reduced the scores for United States credit score for the very first time considering that 2017, shedding complete AAA standing. Every one of these aspects will certainly maintain rates of interest greater for longer, indicating home loan prices will likely float at or over 7% for the near future, pressing even more customers right into the rental market.

The spontaneous mistake of the existing management’s amazingly illinformed toll strategy and recommended tax obligation expense that increases United States financial obligation by trillions will certainly drive rental costs higher too.

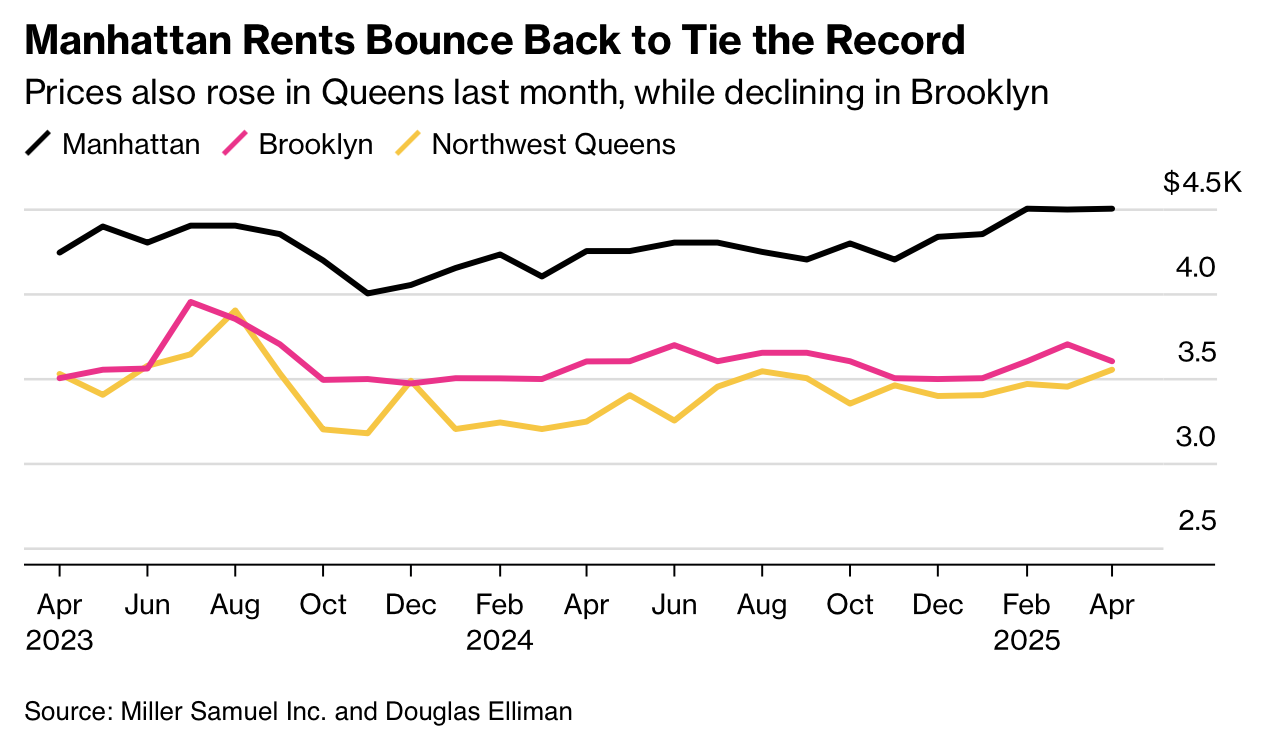

New york city City Rental Fees Get to Records Again

Bloomberg’s tale on the rental market [gift link] was a great take on the higher stress on rental fees.

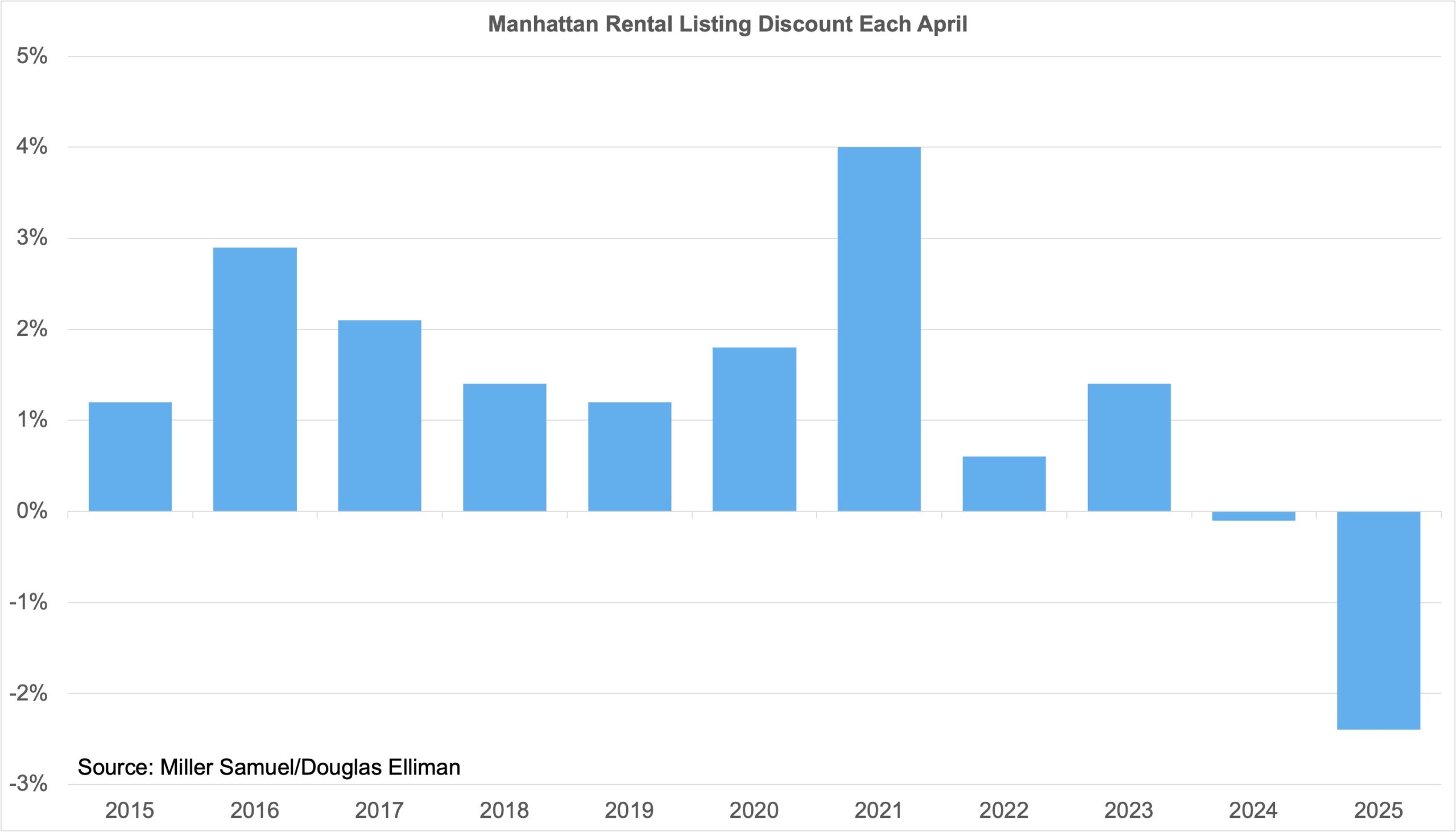

Among the statistics I located intriguing from our study on the New York City rental market recently entailed providing price cut, a statistics that determines the percent distinction in between the listing rate and rental rate throughout the duration gauged. For April, the Manhattan listing price cut was -2.4%, or shared an additional method, the listing price cut was actually a listing costs. The ordinary listing rate of all services in Manhattan was 2.4% listed below the ordinary rental rate throughout the marketplace. We saw a bit of that in 2024, however it is a substantial quantity in 2025 as raised home loan prices reapportion need to the currently limited rental market.

National Rental fees Remain to Rise

The variety of markets where United States occupants require to make greater than $100K has actually increased considering that 2020. Rental fees are remaining to climb, up 30.4% from 2019, which follows what I have actually tracked in our New York City study. According to Zillow, earnings are up 20.2% over the exact same duration, which has actually softened the influence of lease gains. However still, the inflationary style exists over all customers, which is why I remain to raise financial plan appearing of Washington, DC, which has actually stayed separated from the inflationary risk.

Last Thoughts

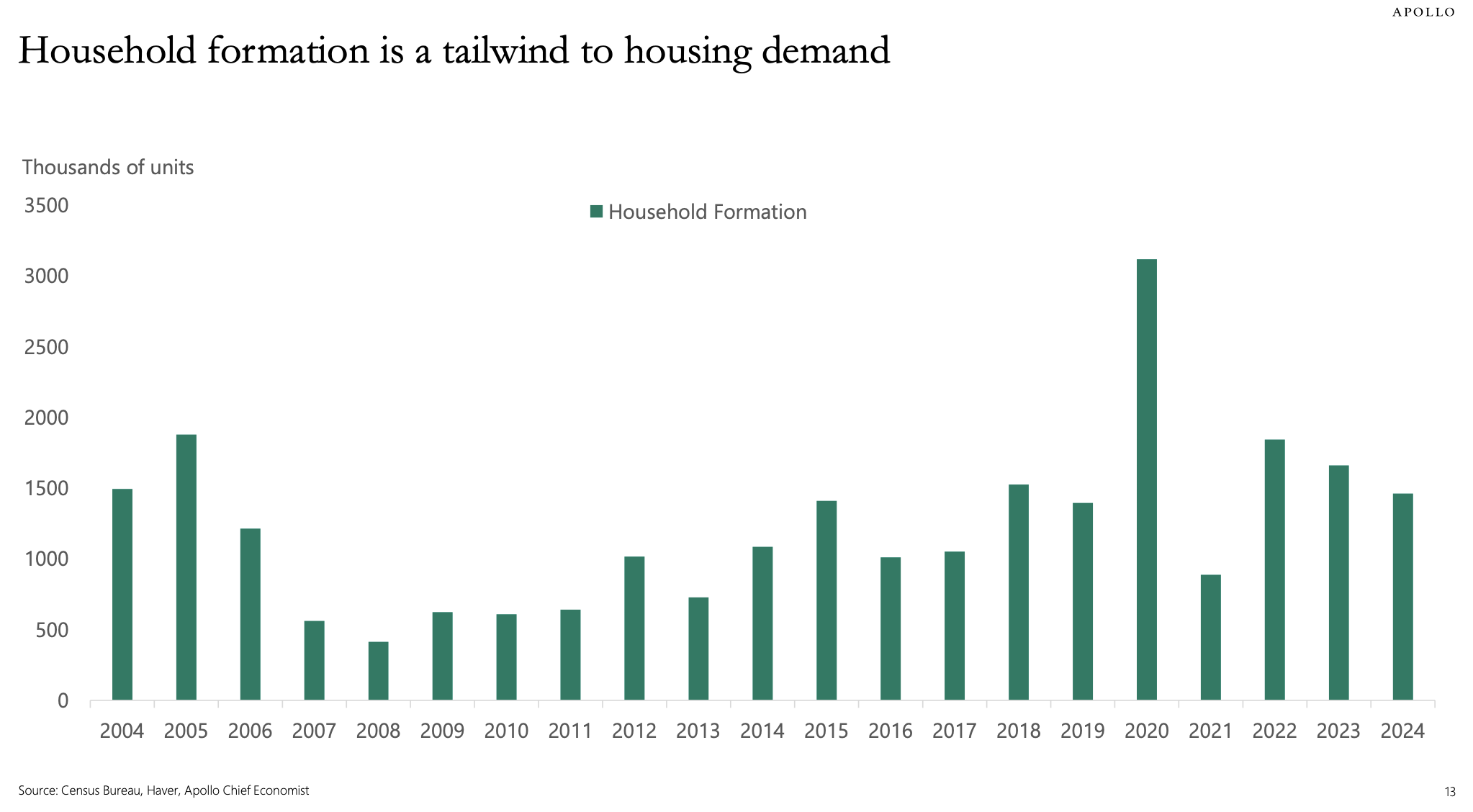

Consumers are minimizing their position of awaiting reduced prices as understandings of rising cost of living plainly reveal they comprehend it’s not vanishing swiftly. Nonetheless, the issue with the existing financial plan appearing of Washington is that it is mainly inflationary and consequently overmuch limiting real estate demand.

Pent-up real estate need is considerable so the instructions of rates of interest can produce a rise in real need in the flip of the button checking out Beauty’s recap:

The Actual Final Thought — Phonebook, when they were about, can inform the tale although I can narrate also without a cape.